This month’s market analysis report on malleable iron pipe fittings focuses mainly on raw material prices, the comparison of order time nodes, the cost of sea freight, and the trend of exchange rates. It is recommended that buyers purchase the product in September or October 2022. It is much more reasonable during this time. The following is a more detailed analysis.

Firstly, the stable price trend of malleable iron pipe fittings.

According to an analysis report published by XIBEN Information on September 9, raw material prices were relatively stable in September with no significant fluctuations.

1. Analysis of the costs

a. This week’s steel price adjustment

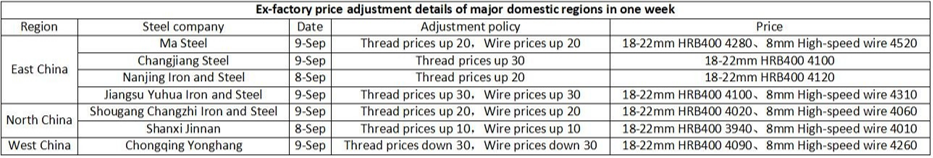

This week, the ex-factory price of construction steel in most regions of the China market rose, and steel mills were more willing to support the price, which supported the spot steel price in a sense. (Please refer to the following table)

b. The raw materials

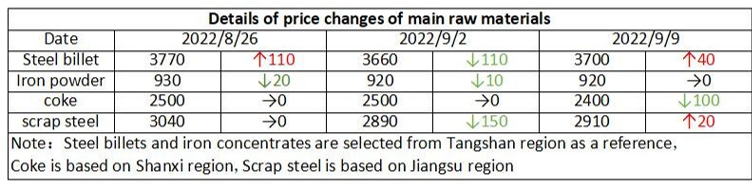

There was a mixed trend in the price of domestic raw materials this week. (Please refer to the following table)

2. An overview of the Chinese market:

a. Steel billet market:

This week, billet steel prices climbed slightly in China market. There was weak demand for downstream steel rolling enterprises this week, as well as an average volume of direct-sale resources. Due to the cooling down of speculative demand, the decline in the social inventory of steel billets has also slowed. However, as the price of finished products stopped falling and rose slightly, the production enthusiasm of billet-adjusting enterprises gradually increased, and quotations from the manufacturers increased. The billet steel market is expected to continue to be strong next week due to high raw material costs and improving demand during the peak season.

b. Scrap steel market:

The scrap steel price stopped falling this week and began to rise, rising by a cumulative 20-80 yuan/ton. There has been an improvement in the scrap steel market this week. The operating rate of blast furnaces has increased in superimposed steel plants, scrap steel resources are limited, and thus the scrap steel market has been improving. Among them, the arrival of scrap steel in East China has decreased significantly, and the price of scrap steel received by small and medium-sized steel companies has rebounded by 30 to 100 yuan per ton.

In North China, scrap steel is relatively expensive, and steel companies are not very motivated to purchase it. It is more difficult to collect scrap steel due to a low inventory of scrap steel in the factory. In order to absorb increased production, the main steel companies have increased their prices by 30 to 80 yuan per ton this week. Considering the current high demand for scrap steel and the limited supply of raw materials, it is expected that the market price of scrap steel will change next week.

c. A number of key hubs have resumed production and work:

Compared to April 18, national railway freight volumes had increased 6.6%, road freight volumes had improved 5.9%, and completed cargo throughput at monitoring ports had grown 10.5% by the end of August. The cargo transportation volume for major international airports increased by 77.3%, and the postal express business volume grew by 31.9%. The major hubs have resumed work and are in full operation.

3.Summary:

Even though there are some influences of COVID-19 in China and demand varied across places, futures fluctuated and the market sentiment recovered. The spot price ended its decline and rebounded. It was a stable month for the consumer market in August. After entering September, supply has increased month-on-month, demand has gradually recovered, the supply and demand structure has continued to adjust, and inventory depletion has been relatively smooth. Market analysts are cautiously optimistic about the future market trend.

Another reason is the material cost regular pattern, usually, the material cost will increase again after The Spring Festival Holiday, and material cost will come down at least in May, or June.

Compared with the future uncertain change, Sep. or Oct. could have a stable price for the malleable iron pipe fittings.

Secondly, the right time to place an order for malleable iron pipe fittings.

Since raw materials for malleable iron pipe fittings are on a downward trend, many customers choose to wait and see if prices will come down next month. It is not a problem to place the orders at a lower price if that is preferable; it is a smart way to save money.

But we believe that the customer should also take into account other factors.

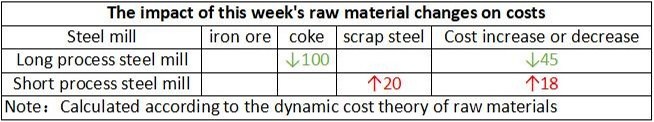

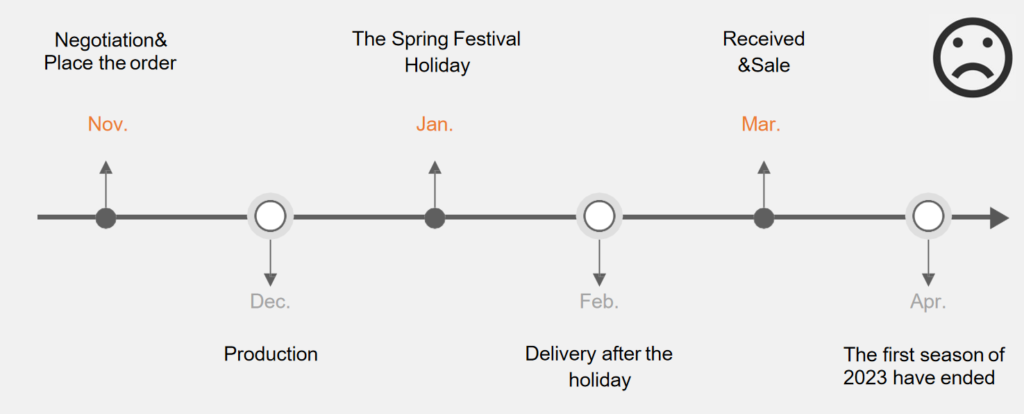

Reason 1: Delivery Time

November and December are usually busy months in China. Customers often place orders in these months. But there are two problems:

- Number one, many Chinese factories stopped producing before the Chinese New Year (CNY) because of environmental protection from the Chinese government, they can’t supply the cargoes;

- Number two, because there are too many orders, some factories’ limited capacity results in a delay. Even if the factory has enough capacity, too many orders mean a much longer time to prepare the production schedule. Of course, they will be not delayed the delivery time. On-time means no advance.

Reason 2: The Spring Festival Holiday

2023 is a bit special, the Spring Festival Holiday is in Jan. That means many factories will start their holiday at the end of Dec. or the beginning of Jan.

Due to a long new year holiday in China, 90% of factories will return to work after the Spring Festival Holiday (around 7th, Feb.). If you place an order in Nov. or Dec., there is a risk some factories won’t be able to complete the orders before the spring holiday, so they will all have to delay until Feb, after the orders are done, they deliver to you. The first season of 2023 will have ended when you receive the goods.

If you place your order in Sep, many factories will still be able to finish your order before The Spring Festival Holiday. Your goods would arrive before the Spring Festival holiday, so you won’t have to deal with the holiday’s delays.

Thirdly, shipping costs have been lower than in previous months.

In the past two years, the price of sea freight has changed drastically, and the constant sky-high freight has made many buyers hesitate.

How dramatic is this change? In the 10 years before the Covid-19 outbreak, it cost about $2,000 to ship a 40-inch container from China to the western U.S., but by September 2021, that price had increased tenfold, and bookings were difficult. The root cause of this series of drastic changes is the global pandemic of severe coronary pneumonia.

First of all, in the early days of the global epidemic, countries around the world were responding to the challenges of the new crown epidemic. The demand for shipping dropped, and shipping companies actively reduced their capacity. However, China quickly controlled the new crown epidemic in a short period of time. This led to a rapid recovery of global trade, a rapid increase in demand, and a rise in shipping prices.

Since then, the COVID-19 epidemic has continued to spread around the world, resulting in the closure of a large number of ports. In addition, the epidemic prevention policies of various countries have also become more stringent. As a result, the efficiency of customs clearance procedures for international trade is reduced. This results in a backlog of containers in ports and difficulties in the circulation of containers themselves.

By the first half of 2021, governments facing economic recession have generally implemented stimulative fiscal policies. However, the congestion problem of the global shipping system has not been adequately addressed. In this way, global shipping costs have risen to crazy levels. Up 10 times, constantly affecting the nerves of foreign trade practitioners.

Things have changed in 2022.

On the one hand, global epidemic prevention has become normalized, the efficiency of ports entering and leaving ports is gradually recovering, and global shipping capacity has also increased. Secondly, the long-term impact of the new crown epidemic on the global economy has begun to appear. People’s expectations of economic recession are getting stronger and stronger, and the demand for shipping has a tendency to fall. In addition, the first half of the year is itself a low season for trade, and the drop in sea freight is very obvious. For example, in May and June 2022, the sea freight for a 20-inch container from China to Saudi Arabia was about $6,000. By August, it had fallen to about $3,000, and it was even about to reach the level before the new crown epidemic.

However, it is difficult for sea freight to drop further. The main reason is that the second half of the year will usher in the traditional global trade peak season. Though the overall demand is not as strong as it was in previous years, it is unlikely that the sea freight price will further bottom out. Instead, a steady growth trend should prevail.

In short, it is the global pandemic of the new crown epidemic that has caused a rare surge in international ocean freight rates in the past two years. With the normalization of global epidemic prevention, the changes in sea freight will eventually return to the normal cycle of previous years. The price of sea freight at this stage has begun to enter this relatively stable cycle. Now, the sea freight price in August can be considered to be at the bottom in the near future and in future. For some buyers who are more sensitive to sea freight, now is indeed a good time to place an order.

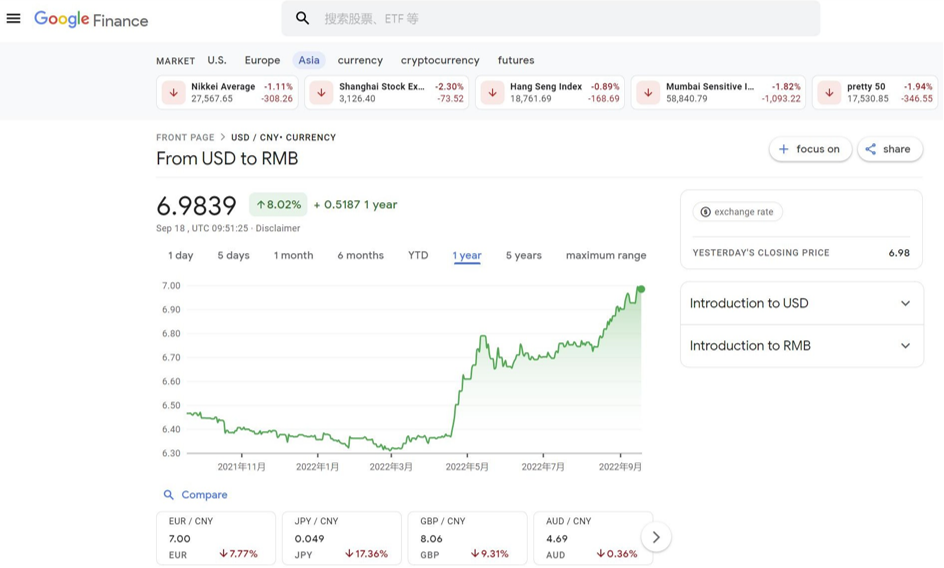

Fourthly, the value of the U.S. dollar increases, thereby increasing purchasing power.

This is the first time the RMB exchange rate has fallen below the integer point “7” after more than two years, bringing it back to its lowest level since July 2020. Foreign exchange rates of the offshore RMB against the US dollar reached a minimum of 7.0187 at approximately 18.30 on September 15th, 2022.

According to Ping An Securities’ chief economist Zhong Zhengsheng, there are two triggers for the recent decline in the RMB exchange rate: on the one hand, the US dollar index recently reached a 20-year high, followed by further increases in the US dollar; on the other hand, China and the United States have diverged in their monetary policies, and the yield differential between China and the United States has deepened.

Considering the rising risk of global economic recession, the market is concerned that export growth will drop rapidly. The depreciation of the exchange rate will enhance the competitiveness of export products to some extent. In comparison to the past, the same amount of US dollars can be exchanged for more RMB, allowing more goods to be purchased.

As a result, based on the current exchange rate situation, it is also a good time to place an order for the malleable iron pipe fittings.

Data Sources::https://www.google.com/finance/quote/USD-CNY?window=1Y

Overall, September and October 2022 are the most advantageous times to order malleable iron pipe fittings, regardless of raw material prices, order time comparison, shipping costs, or exchange rates.

We also welcome customers to place orders with Hebei Jianzhi Casting Group in September or October. We are able to guarantee delivery within 25-30 days. Additionally, Jianzhi is not subject to the environmental protection laws of the Chinese government, as we have obtained a production license. As early as December, you will be able to receive the goods. When you return from your new year holiday, you will be able to immediately begin your business.

Best regards,

Hebei Jianzhi Casting Group Co., Ltd.